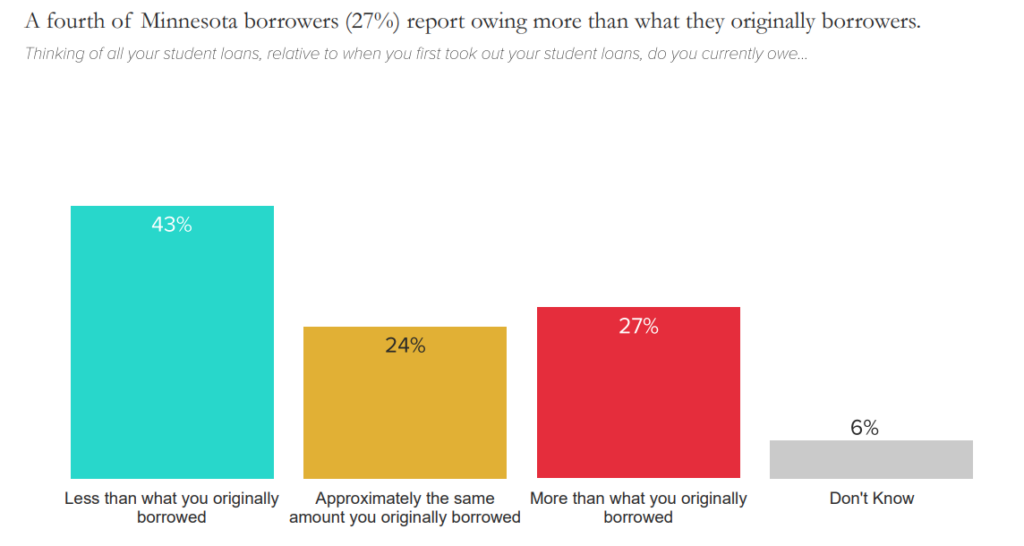

Three-quarters of Minnesota student loan borrowers say their student loans cause them stress and most report they would have trouble paying for an unexpected expense or are already falling behind in their finances, according to a poll released in March.

Education Minnesota partnered with the Center for Responsible Lending to poll Minnesotans about education debt, as part of our Degrees, Not Debt program. The CRL is a national group working to ensure a fair, inclusive financial marketplace that creates opportunities for all credit-worthy borrowers.

The poll comes as Minnesota lawmakers consider the Student Borrower Bill of Rights, which as of press time has been moving through the House and the Senate. The bill would provide oversight over student loan servicers and hold them accountable for serving borrowers fairly and responsibly. Problems with servicers include misleading information, misapplied payments and failure to place borrowers into the income-driven repayment plans for which they are eligible, which adds to their debt load and makes covering living expenses more challenging.

“College affordability and education debt are no longer just a burden — they have become a barrier to the American Dream. And loan servicers are part of the problem,” said Education Minnesota Vice President Bernie Burnham. “Borrowers in low-wealth, rural and communities of color are harmed the most. This poll shows strong support for bold solutions, and one clear need is holding servicers accountable through the Student Borrower Bill of Rights.”

The vast majority of poll respondents support major reform across party lines, with 79 percent supporting an office to take student loan complaints and advocate for borrowers.

The poll also found that Black and Latino students struggle to fund their college experiences due to broad societal discrimination, and they are targeted by poor quality, for-profit institutions that fail to provide reliable educational benefits. As a result, students of color accumulate high levels of unmanageable debt. Almost half of Black graduates owe more on their undergraduate student loans four years after graduation than they did when they received their degree, compared to 17 percent of white graduates.

The poll also found more than half (51 percent) of Minnesota’s student loan borrowers struggle to afford their payments. Borrowers also report that they have delayed saving for retirement (50 percent), put off buying a home (29 percent), been unable to buy basic necessities like food or clothing (26 percent), put off starting a family (20 percent), or have gone without medical care (17 percent) in order to pay their student loans.